|  |

|  |

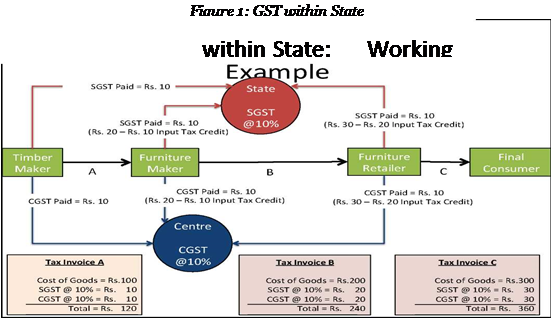

Question 1. How would a

particular transaction of goods and services be taxed simultaneously under

Central GST (CGST) and State GST (SGST)?

Answer : The Central GST and the State GST would be

levied

simultaneously on every transaction of supply of goods

and services except on exempted goods and services, goods which are outside the

purview of GST and the transactions which are below the prescribed threshold

limits. Further, both would be levied on the same price or value unlike State

VAT which is levied on the value of the goods inclusive of Central Excise.

A diagrammatic

representation of the working of the Dual GST model within a State is shown in

Figure 1 below.

Question 2.

Will cross utilization of credits between goods and services be allowed

under GST regime?

Answer: Cross utilization of credit of CGST between goods

and services would be allowed. Similarly, the facility of cross utilization of

credit will be available in case of SGST. However, the cross utilization of

CGST and SGST would not be allowed except in the case of inter-State supply of

goods and services under the IGST model which is explained in answer to the

next question.

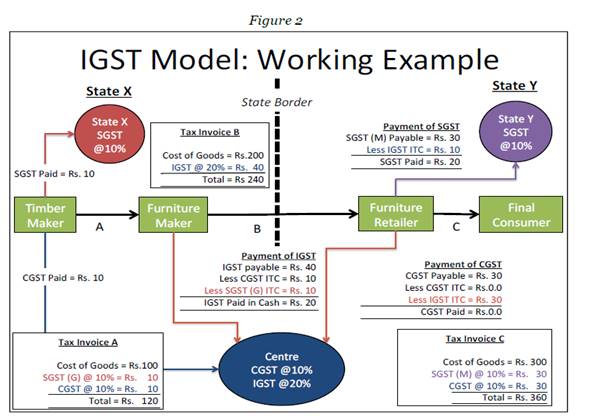

Question 3. How will be

Inter-State Transactions of Goods and Services be taxed under GST in terms of

IGST method?

Answer: In case of inter-State

transactions, the Centre would levy and collect the Integrated Goods and

Services Tax (IGST) on all inter-State supplies of goods and services under

Article 269A (1) of the Constitution. The IGST would roughly be equal to CGST

plus SGST. The IGST mechanism has been designed to ensure seamless flow of

input tax credit from one State to another. The inter-State seller would pay

IGST on the sale of his goods to the Central Government after adjusting credit

of IGST, CGST and SGST on his purchases (in that order). The exporting State

will transfer to the Centre the credit of SGST used in payment of IGST. The

importing dealer will claim credit of IGST while discharging his output tax

liability (both CGST and SGST) in his own State. The Centre will transfer to

the importing State the credit of IGST used in payment of SGST. Since GST is a

destination-based tax, all SGST on the final product will ordinarily accrue to

the consuming State.

A diagrammatic representation

of the working of the IGST model for inter-State transactions is shown in

Figure 2 below.

Question 4. What is the format of

Provisional ID?

|

|

Format of

Provisional ID |

|

|

|

22 |

AAAAA0000A 1 |

M |

5 |

|

|

'-------- '------- ' y |

y |

Y |

|

State Code |

Permanent Account Number

(PAN) Entity number of |

Alphabet 'Z'by default |

Check sum

digit |

|

|

the same DAM

hnUor |

||

|

|

kan noiaer in a state |

|

|

Question 5. What is ARN? What is the

format of ARN?

ARN refers to Application Reference Number. It is a unique

number assigned to each transaction completed at the GST Common Portal. It will

also be generated on submission of the Enrolment Application that is

electronically signed using DSC. ARN can be used for future correspondence with

GSTN.

Format of ARN

AA 07 07 16 000000 1

•nr1 V V V 1---------------------- 1------ 1 Y

Alphabets State

Code Month Year

Six digit-System generated code Check sum digit

Miscellaneous

1. I have multiple businesses in

one state registered using the same PAN. Do I need to enrol each business

separately with GST?

As one PAN allows one GST

Registration in a State, you may register one business entity first. For the

remaining business within the State please get in touch with your

Jurisdictional Authority.

2. What is ISD Registration?

ISD stands for Input Service Distributor. An Input

Service Distributor refers to a person who distributes credit, in respect of

the tax invoices of the services received at the Head Office, to its branches

where the services have been supplied actually. Tax invoice refers to the

invoice issued under Section 23 of the Model Goods and Services Act.

If you are an existing ISD Taxpayer, you need to apply

afresh in the GST Common Portal for the State in which you desire to seek

registration. For that you need to inform your Central Jurisdictional

Authority.